Protect Your Family’s Future with Ethos Life Insurance

This is a partnered post with Ethos Life Insurance.

In our family, we have 6 kids and 2 working adults. Our family depends on the income from my husband and I to make it, especially with all of the expenses that comes with having a big family. But what if something happens to my husband or me? We would be up a yucky creek without a paddle! That’s where Ethos comes in to protect our family‘s future.

What does Ethos do?

Ethos makes life insurance simple and accessible for the modern consumer. Ethos makes it easy to sign up for life insurance. In fact, anyone can use their website to apply for term life insurance – it’s 100% online and FREE! I love it because there are no pushy salespeople, hidden fees or medical exams for most people. Ethos focuses solely on term life insurance, which is much more affordable and simpler than other types of life insurances out there.

What is term life insurance?

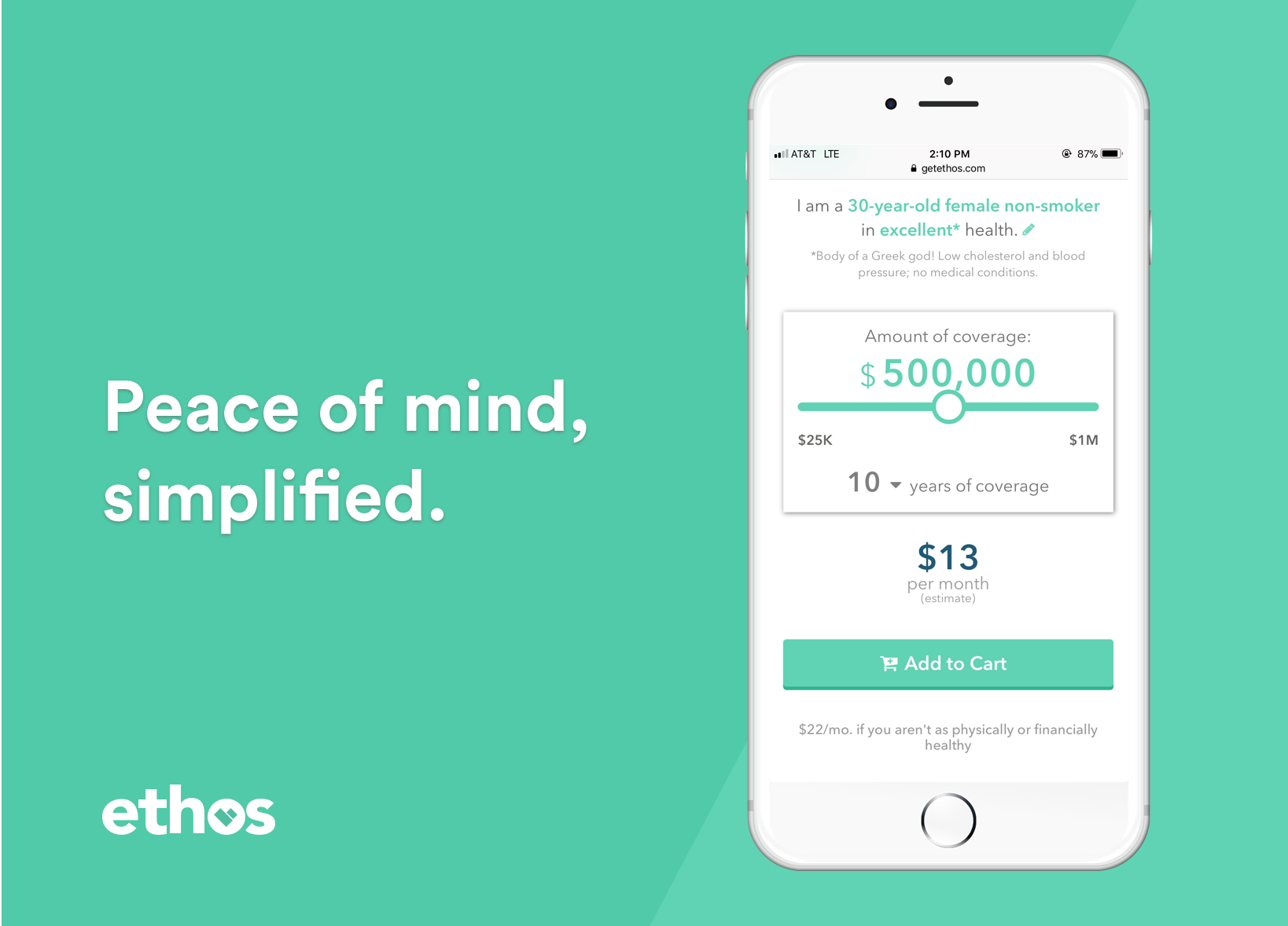

I don’t know about you, but when I think of life insurance, I get a little bit overwhelmed because I don’t really understand what it is or how it works. As I mentioned above, Ethos focuses solely on term life insurance. Term life insurance is life insurance that covers you for a set amount of time. Ethos offers policies in 10, 15, 20 or 30-year terms. You can make monthly payments, called “premiums,” to keep your policy in effect. If you pass away while the policy is in effect, a pre-set cash payment is paid to whomever you name as a beneficiary. At the end of the term, the policy expires and is no longer in effect. Term life insurance is actually the best type of life insurance for most families because it is by far the most affordable and simplest type of life insurance.

Why Ethos?

Unfortunately, buying life insurance the traditional way has been a poor experience for a lot of people. There is typically a lot of back and forth with an agent, mandatory medical exams (plus blood and urine tests), as well as the fact that the process takes several weeks (10 weeks or more is common)! Almost all life insurance is sold by commissioned salespeople and since their time is money, they may try to push you into buying the most expensive coverage available, even if you don’t really need it.

Ethos is a better way to buy life insurance! The online buying experience with Ethos puts you in the driver’s seat – yay! There are no medical exams for 99% of people (they provide coverage for all financial situations – $25k – $10m). You can apply for FREE in as little as 10 minutes. Most healthy people get approved instantly. There is no upsell – they’ll never try to convince you to buy more life insurance than you need or can afford.

What I love about Ethos is that while it provides the benefits of a modern consumer experience, it also provides the security of a major life insurance company. Ethos has partnered with Assurity, an “Excellent” rated life insurance company with 130 years of experience. Ethos is awesome because most claims are paid within 10 days and they will even help your family through the process. Their prices are competitive (for instance, $1 per day could buy your family $1 million of coverage for 20 years). Keeping their customers happy is their number one priority. They are available anytime via phone or email to answer questions.

Who should get covered? How does Ethos help my family?

Who should have life insurance? The need for life insurance depends on what stage of life you are in. At Ethos, they believe that you should get covered if you have someone you want to protect financially in the event you pass away, such as a spouse or children.

Households with Children and One Income

- When the household is dependent on one wage earner, there is a great need for life insurance that will financially provide for the future.

- Households with young children and one income are in the greatest need of life insurance that will help keep finances intact in the event of an untimely death.

- In this situation, it’s important to address the need for life insurance as soon as possible.

Households with Children and Two Incomes

- In this case, the death of either parent presents a financial hardship that could be significantly alleviated with life insurance. And if you need advice on guardianships, then make sure to consult the experts.

- Both parents need coverage that could replace their income for several years, and where possible, pay off a mortgage, take care of outstanding debts, and provide for the kids’ future educational needs. Our article highlights the most frequent common disputes in probate that families face.

Married Couples, No Children

-

- If both spouses are employed and contribute equally to the household‘s finances, they may choose to wait until they purchase a home or decide to have children before buying life insurance.

- However, if the death of a spouse would cause financial hardship, buying life insurance to alleviate that strain is a smart move.

Ethos is definitely a great life insurance option for families everywhere! I highly encourage you to check them out and sign up to protect your family’s future today.

Have you heard of Ethos before? Why do you think life insurance is important?

[wl_faceted_search]

We are lucky we have insurance through work but we are also thinking of quitting and life insurance came up as a reason to stay. Its tough without that life insurance.

Life insurance is so important, one of the things you hope you don’t need but is so important in the event you do need it.

I haven’t heard of Ethos before. Life insurance is important so if something happens at least someone can be buried and maybe some debt cleared and not passed on.

I need to give Ethos a look. We’re in the process of getting life insurance, and it is painful. I hate it so much. I’d love SIMPLE!

Talk about convenience! I love that Ethos makes it easier for all of us to apply for life insurance and they even have an app that we can use! I’d love to check them out!

Life insurance is so important. When my hubby and I first started dating one of the first things we did was get life insurance policies. We don’t have Ethos where we are but comparable companies. I’m pretty sure our policies are Term Policies but now I’m going to look into that.

Insurance period is essential. So glad we have it and it’s affordable.

Life insurance is very important. I like a life insurance that doesn’t come with conditions, as you’ve mentioned about Ethos.

My husband gets life insurance through his work. I agree that life insurance is important.

Insurance is vital. It protects us in more ways than we can imagine at the time we buy it!

I’ve never heard of Ethos Life Insurance. It’s great that you brought up that they don’t require a physical or hidden fees. Might be worth checking out!

Figuring out what kind of life insurance to buy can be so tricky. Thanks for de-mystifying it a little!

I have never heard of Ethos before but it is important to have life insurance. I have battled with getting it for myself and my husband his. This was a good reminder.

We have life insurance, but I know it isn’t enough. I want to set the kids up for life. I think Ethos is something I need to look into.

Just when I thought that getting insurance will always be confusing, in comes this new app! I think it’s going to make life really convenient for everyone who’s planning to get insurance!

We are looking for life insurance. Me and my husband never had life insurance but we would love to try Ethos! Great review!

Ethos sounds like an easy way to protect your family. I do agree that life insurance is important 🙂 I am going to pass this along to some friends who are searching for life insurance.

Thanks so much for bringing this topic up. While it could be considered somewhat morbid, better safe than sorry (especially when you’re the breadwinners!). Finding a policy has been on my “to-do” list for a while… This looks like a great place to start the research. 🙂

Absolutely agree! It’s important to set up a life insurance policy to provide some support for your family in the event of your untimely demise. It’s kinda creepy to think about but it’s a must.

I think everyone should invest in life insurance. You never know what tomorrow could bring and you don’t want to leave your loved ones holding the bag on your final expenses. I saw a family begging on the street for money to pay for their grandma’s funeral recently. I would never want to have to put my family in that kind of position if I could have prevented it with a life insurance policy.

We need to look into this! I love that it is online and free! With two kiddos, those two things are very important ha ha. But we really do need to looking to life insurance and this is the perfect place to start.

We’re actually shopping for insurance now so this is perfect timing. I’ve been putting it off because it was always a nightmare. I’m clicking!

I’ve not heard of this life insurance company before. They sound amazing and I’ll be checking into them further.

I have really been thinking about this. It seems like it is a really smart choice.

Having life insurance is really important. I think this is a great reminder for everyone!

This is something that is really important for couples to think about. My husband and I got coverage a few years into our marriage, before we had kids. I will have to ask my daughter if she’s got life insurance too. If not, I will recommend she take a look at Ethos.

This is really great. My family wasted a lot of money on life insurance so I want to do it my own way this time

Haven’t heard of the brand before but love the online ability to apply and bypass sales people. It’s one of those insurances that are so important.

Yes! Life insurance is so important for protection, definitely until your kids are out of school! And then after that, but at least it wouldn’t have to be as high after that hopefully. I know I wouldn’t ever want to be put in a situation where we wouldn’t be able to pay our bills if something happened. This sounds like an easy way to protect yourself.

I haven’t heard of this insurance company before. I love hearing about different options.

I really like that it focuses on terms. That’s an important aspect to me when searching for life insurance.

I haven’t heard of Ethos but it sounds like a great company. Having dealt and other companies before I know what a challenge it can be to get things done the right way. I’m still doing battle to this day. It’s important to life insurance to take the burden off your family should something happen to you.

Thank you for sharing this. Getting insurance is so important, and so many people really don’t consider it.

My husband and I have talked about getting this. It is in the agenda for next month.

I haven’t heard of Ethos before but I feel like I know a lot more about life insurance after reading this! I really appreciate the part about who should get covered, I am not at that point quite yet in my life but at least now I know what to look for when I get there!!

We are very fortunate to have life insurance through my husband’s union. It is definitely important especially when you have children.

That sounds great, though I’ve never heard of ethos before. Life insurance would come quite in handy someday that’s why it’s important to have one as soon as possible.

Sounds like something worth checking out! I’ve never heard of ethos before but it sounds like something everyone should check out!

I have never heard of them before. I know that I need to start looking into life insurance though.

This is the first time that I’ve heard of Ethos, but I do think that Life Insurance is so important for your family’s welfare and peace of mind.

Life insurance is such an important thing to consider getting. You never know when it’ll be needed and it’s better to be covered.

I had not heard about Ethos but I know that life insurance is a great option to have when it comes to thinking about family financials.

I started off in the Financial Industry straight out of College and the benefits package was extensive. Our HR Team definitely stressed the importance of life insurance, and I was then and still am single with ZERO dependents and still thin it is as important to have today! I would not want to leave family members with the burdens of burial and funeral costs which I know is quite daunting, especially if you are un=prepared for it.

You are right, especially for a big family, having a life insurance is essential. You never know what will happen in life so at least your kids will be financially secured. This concept sounds like a good way to do it.