Protecting Our Families with Jenny Life Insurance

This is a sponsored post with Jenny Life Insurance and BraVoMark. All opinions are mine.

I don’t know about you, but I really don’t like to talk about or even think about dying, but it happens to all of us at some point in our lives. As a mom, my top concern is the safety of my family. The next concern is their happiness. I can’t imagine them going through life without me here, but I know I won’t be around forever and I want to protect them while I can (as well as when I’m not).

Since I became an adult, I’ve made sure I had health insurance, auto insurance and renter’s insurance. However, I’ve never really thought about getting life insurance until I discovered Jenny Life Insurance. At one point, I started looking at getting life insurance, and I have to be honest, the process of even getting started was overwhelming and a big pain in the butt! It typically goes something like this: find a price quote on the Internet, wait weeks for your scheduled medical exam where you get a blood test and give a urine sample, take part in an exhaustive phone interview with a bunch of questions, then wait several weeks for your application to go through. And, if you’re not accepted, start the entire process over again. Frankly, the life insurance process is just not mom-friendly. I don’t know about you, but with all the busyness of being a mom and working from home full-time, I just don’t have the time to do all of that!

Securing insurance coverage is a responsible choice, but the complexities and time-consuming nature of the application process can be a deterrent. This is particularly true for busy moms like yourself, who juggle multiple responsibilities. However, there are solutions available to simplify the life insurance experience. Websites like https://insuranceranked.com provide a user-friendly platform that streamlines the process, allowing you to easily compare quotes from reputable insurance providers. By leveraging technology and efficient online tools, you can save time and find the right life insurance coverage that meets your needs and provides peace of mind for you and your family. With Insurance Ranked, navigating the insurance landscape becomes more accessible and convenient, empowering moms and individuals alike to protect their loved ones without undue hassle.

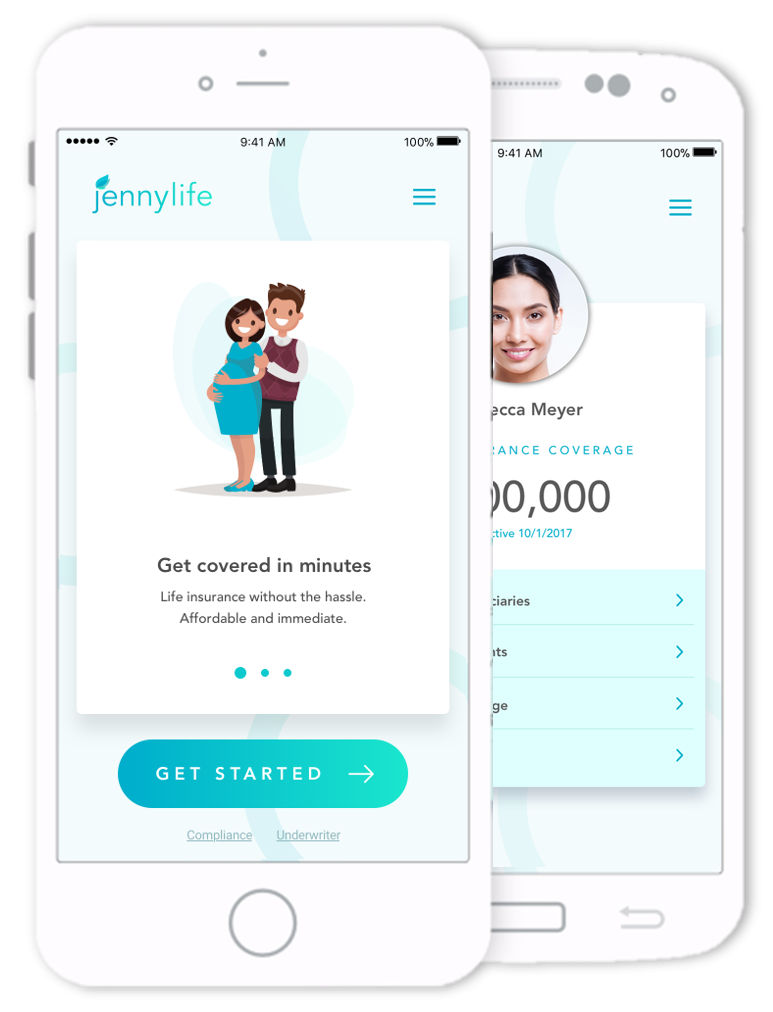

That’s where Jenny Life comes into play. Their Seattle-based team of insurance specialists and software engineers teamed up to build a much better process. The result is a mobile application for your Apple or Android phone that allows you to get a quote and apply for life insurance in a few minutes, entirely EXAM-FREE! You read that right. You can get life insurance without ever having to sit in an exam room or have a nurse come to your home.

Although Jenny Life works for anyone, it was built specifically with moms in mind. How cool is that? “Over 60 percent of mothers don’t have life insurance and we view this as a public policy issue,” said Chirag Pancholi, co-founder of Jenny Life. The company set out to make it incredibly simple for moms to access life insurance. “We believe that accessibility is the number one reason so many moms don’t have mortality protection to cover their children and household and we felt certain we could help change that.”

“We simply don’t believe an online GoFundMe campaign is a life insurance strategy,” said Pancholi when discussing how uninsured households are closing the financial gap when a parent passes away unexpectedly. He continued, “There is a tremendous financial burden when a parent dies in an auto accident or from a severe illness and an appropriate level of life insurance coverage can be a godsend.”

Jenny Life Insurance recently interviewed four women who lost their spouse and the feedback they received was pretty damn scary! What they found most powerful was that they all four mentioned the following key pieces as being problems (even though they were interviewed individually).

- All stated that they wished they had MORE life insurance

- All were surprised by how LITTLE the policy face value was through their spouse’s employer

- All were uncertain (at first) about how they would get the insurance $$$ (payout/redemption)

- Anticipate that some will try to take advantage of you (e.g. overcharging for expenses) during your time of weakness. Discuss all financial transactions above a couple hundred dollars with a friend/family member to make sure the purchase/financial decision is sound.

- The big recommendation from all women was to immediately connect with a friend who has lost a spouse as they can prove a source for a wealth of information. And to build a “support team” of 3-5 friends/family that you can put around you. Ask them for help and lean on them for help.

- They recommend that when you lose someone to start two boxes: 1) one for bills, 2) one for condolence cards. You’ll want to have a central place for all the bill that you can in time organize. Many condolence cards include thoughtfulness and even $$$. In time, you may want to send out hand-written notes and thank you cards to some of those people who showed they care. The process can prove therapeutic.

- They said to expect that the groups you hung out with previously can change. Two women cited being felt like they were left out because their spouse was no longer alive

- Learning how to cope with the state of shock/blur/cloud/haze was difficult.

- Anticipate people who you think you should be able to lean on won’t be there to support you, and people who you could have never imagined will step up and help you.

- They suggested finding a counselor, therapist or other mental health professional who you can work with.

The Jenny Life application is awesome and allows you to get an instant quote and apply for life insurance entirely from the mobile phone, and is available in 48 states (not Montana or New York, yet). You can download the app and get a free quote by searching “Jenny Life” in AppStore, Google Play, or links are available via the website at www.jennylife.com. The company also built a nifty little tool at their website where you can drop in your mobile number and they’ll text you back with the mobile app.

What do you like about the Jenny Life app?

[wl_faceted_search]

Having life insurance is SO important for all families. I need to check out Jenny Life!

I have to give this a look. We’ve been talking about getting life insurance, but we haven’t done it yet. We really have to stop putting it off.

I don’t have life insurance and my husband says I don’t need it but I am not sure. I will check out the people at Jenny life and see how this can help my family.

This is a very important post. We had life insurance until my hubby lost his job. So we were able to extend it on our own, for a lot of money. We have a teenage son, so it is important to have a financial backup plan, and making believe we are immortal is not the plan!

I can’t stress enough the importance of having life insurance. I shall talk this over with my husband while we take a look at it.

We’ve seen what happens when you aren’t prepared with life insurance and it is not pretty! This sounds like a great plan. I love the app!

I like the convenience of being able to apply for it using your phone. No medical exams required and your application processed and approved in minutes? Wow. I have to check out this Jenny life insurance. Sounds awesome!

We haven’t heard of this but we definitely need to look into this app. Specially now that we have a baby to care for. We need to do our best to prepare for his future too.

I am always amazed when I hear people say that they do not have life insurance, especially parents. This makes it easy so everyone should get it now!

I’ve never heard of this before til now. I’ll have to look more in to this. I could really use an insurance like this anyways.

Life insurance is so important! You never know what may happen and it insures that your loved ones are taken care of once you’re gone!

My husband and I definitely need life insurance. It’s a scary thought but I know it’s necessary, especially when you have kids to think about.

I believe having life insurance is very important especially if you have kids. Good to know about this app where it’s easier to know all about it.

I think that is Mom Crush Monday on one of the photos. This is great and it even has an app!