4 Tips for Saving in the New Year

![]()

It’s the beginning of the year and that means that many of us are setting New Year’s Resolutions (or goals). Whether it be saving more money or paying off debt, getting control of our finances is something that can deeply impact our lives. While there are different ways of creating a budget out there, there aren’t very many that I’ve found to be easy to use, yet alone free! Let me introduce you to EveryDollar.

I started learning about saving when I was a young girl. I remember my dad taking me to the bank and setting up a child’s saving account. It was back when they gave you a savings booklet where you could record the transactions and know how much you had in your account. Man, that was a long time ago! I would do chores on the weekends when we’d be with my dad and he’d pay us an allowance. I would then put part of that money into my savings account. As time went by, my savings dollar number got bigger and bigger. I was seeing a plan in action working effectively and it was awesome!

4 Tips for Saving This Year

While it was easy to save as a kid, I will say that with daily expenses and those yucky, unexpected expenses, it can definitely be more of a challenge to save. However, it is necessary. I can’t stress that enough. Let’s also not forget that we just had Christmas with a family of 8, so there was a lot of outgo we had in the past month! Ok, so how does one starting saving then?

Step 1 – Make a decision.

While it is great to want to have more money in your checking or savings account, you need to make a decision to make it happen. Make it real! Start your wealth management planning and set your goals – whether it’s saving money or paying off debt, set goals and keep them realistic.

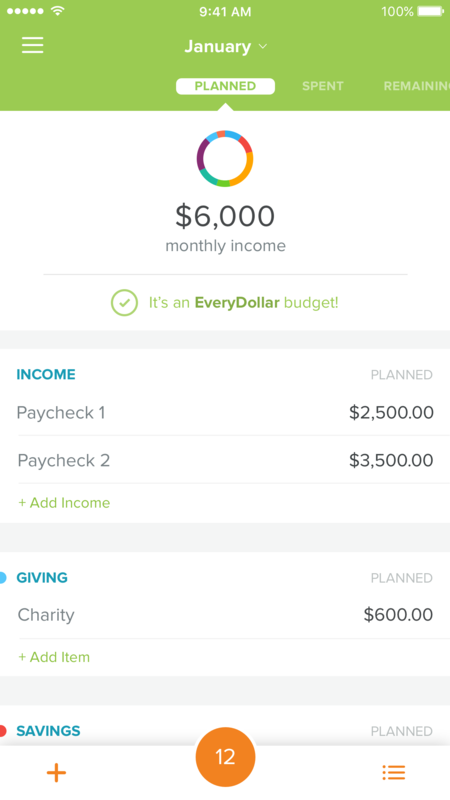

Step 2 – Sign up for the EveryDollar app.

What is the EveryDollar app? EveryDollar is an app that is free and super easy to use! It literally takes less than 10 minutes to create your first budget. With EveryDollar, you create a budget using every single dollar. This helps you manage your money and track spending on the go. Download EveryDollar app (available on iOS, Android and online).

Step 3 – Assign Every Dollar.

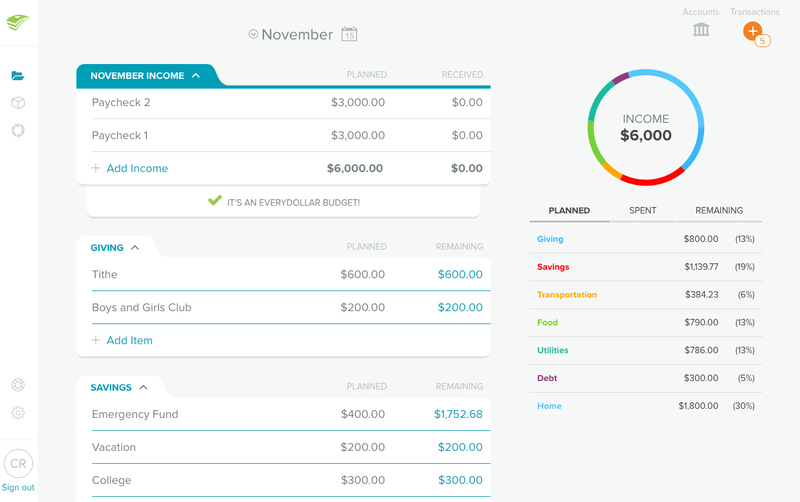

Within the EveryDollar app, you create a planned monthly budget. This means you enter in the amount of income planned to be received during the month, as well as the amount of expenses planned to go out. By assigning every dollar, you’ve created an effective budget. To increase your savings, I would encourage you to assign a set amount per paycheck or month to add to your Savings account.

Step 4 – Track your spending.

While having a budget is a good idea, following your budget is an even better way! It’s amazing how quickly the transactions can add up when you’re not monitoring them. Trust me, you don’t want to find your checking account with less money than you thought you had – adversely affecting pending transactions not yet accounted for.

EveryDollar is a great app, but you can also get EveryDollar Plus – an upgrade to the original plan. With EveryDollar Plus, you can connect your bank account for faster expense tracking. You can also view account balances within EveryDollar and sync accounts across multiple platforms, as well as create unlimited budgets.

With 2017 now in full swing, I would encourage you to take control of your finances and start building your savings. Anything can happen in life and it will be better to be prepared. A big thanks to EveryDollar for developing a great app that makes budgeting easy and effective!

What aspects do you like about EveryDollar?

That is amazing! I love how you can budget out every single dollar, AND that it helps you track all your spending. If this can’t keep someone on a budget, then nothing can!

This app looks like a must try for me. I have been making my own lunches and saving the difference.

I am trying to save up for a trip. These are great ways to save. I have been making my coffee at home instead of hitting the coffee shop in the mornings.

I do a manual budget. I wonder if I can move to an app like this an budget online? Baby steps…

I am loving the sound of this app. We follow a budgeting and saving system and I think this could help keep our family on track. Thank you for the introduction, sharing this with my husband now!

That app looks great! I really should sit down to budget out our money, but we really never have to worry much. It would be nice to feel more in control!

I’m all about saving money, so any tips I find are helpful. I will download this app.

I would say that this is a really cool app for tracking the savings. Thanks for sharing the review.

This is really helpful, saving is not always easy but this will helps a lot.

Right now I handwrite this information and create a budget but the minute I get busy all my expenses start slipping and I’m not writing everything, probably going to an app or online program would keep me better on target.

This app looks pretty interesting. It seems to have great ideas on ways to save money. I need to check this out ASAP!

I’m pretty good with my finances, I’d have to say… These tips are great ones to keeping yourself in check and not over spending on things you don’t really need… there seems to be so many apps for ALL things these days, super helpful : )

Great tips, and I will have to check out the app. I know in the past the best way to save is to stay on top of finances, when you know what is going in and coming out with money you are able to see places you can save.

I think I am going to have to look into getting this app. With my son starting college this Fall, I need to make sure we make…..and stick to a budget. What a great tool!

We’ve been working at tracking our spending better, will have to try this app out as well.

Great app for those that need to get a handle on this. I dont have a smartphone, so I cant use it, but then again that is one area I save money on! I use a phone for emergencies, it doesnt have the net nor anything but call in and out. I think many use debit cards and it gets away from them, there is no place to look quickly what balances are. I use a checkbook.

I need EveryDollar in my life! I usually do very well with sticking to my budget, but even I could use some help.

This sounds like an amazing app for budgeting!! I know that we are working this year on cutting back our spending and over spending.

I believe managing money is so important! It is critical to do if you are on a tight budget too!

I think this is something i need to track my dollars. I will download this app. Thank you for sharing.

Interesting app. I think it will really help me in tracking where my money goes.

This looks like an awesome app! I need to try it out seeing as I am the one that handles the finances. Thank you for showing me this!

I actually just started using the EveryDollar app last month. I love it so far and I look forward to using it all year and see if that helps.

EveryDollar looks cool. I just got a new car so I definitely need to get on a budget for 2016. Thank you for sharing. – yolonda

what a great app for those who need a little help planning and wanting to budget a little better… love how the app lays it out with easy to read progress on saving your money.

I remember those paper savings account records. Just thinking back, it would be horrible if you lost that book. My grandparents set me up a savings account too. I tried doing it for my kids but things didn’t work out the way that I wished.

I need to check out this app.

These are all great tips. I try to save as much as I can. I love that there is an app. I’ll check it out.

One of the things that worked for me in the past is tracking my expense. Knowing where the money goes makes you more aware of your spending.

We keep talking about doing a better job of tracking our spending. We know where the big things go but it seems like our grocery budget seems to slip away from us every month.