September is National College Savings Month!

It’s September and that means it’s National College Savings Month! With 6 kids, it’s gonna cost a lot to help them through college and that means starting to save for their future now. Saving for the future means different things to different people – whether it’s to save for your child’s future, pay off student debt, buy a home, or anything in between.

Frank and I have a few different credit and debit cards. My favorites are the ones that give us cash back. It’s great to earn cash back on money you would be spending anyways. We use them to pay bills, for our travels and daily purchases – building up our cash back savings month by month.

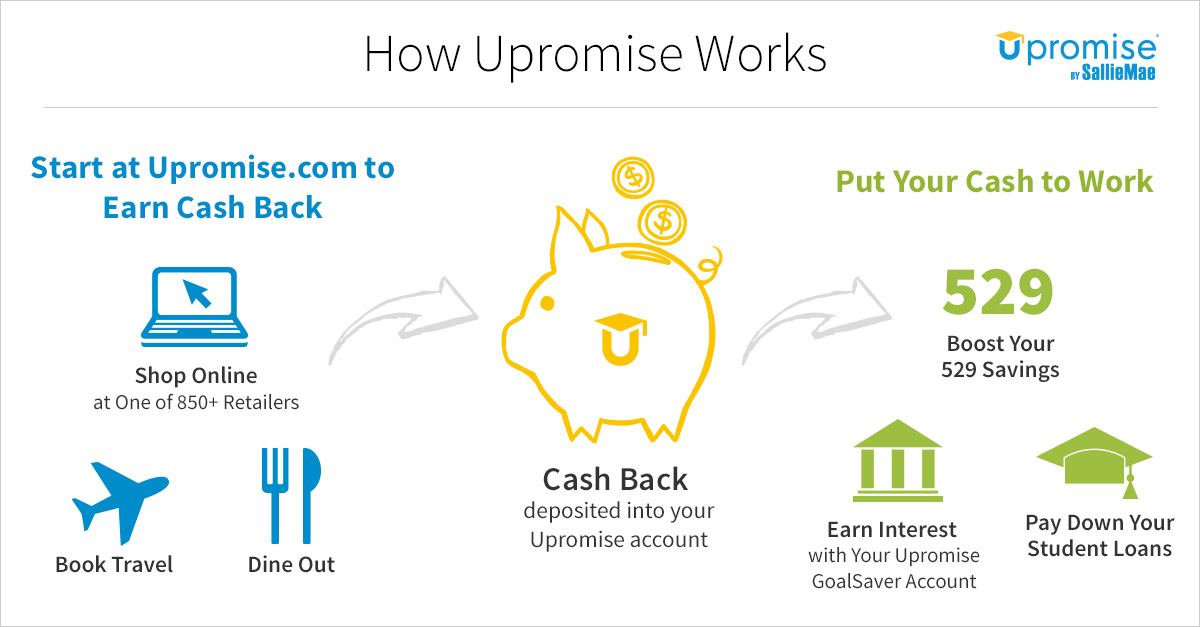

When you join Upromise, you can earn cash back on the things you already do and buy. It’s also a smart way to earn cash back. Just by shopping online, going out to eat, booking travel, and more you can start saving for your future– college, retirement, student loans, babies, weddings and more!

We recently discovered the Upromise MasterCard®. Upromise® by Sallie Mae® is free to join, and simple to use. They earned how much!? Upromise MasterCard cardmembers have earned $500 million in cash back for college. Get the card that helps you ace your savings.

With the introduction of the Upromise MasterCard, members have even more ways to earn cash back — to date card members have combined to earn $500 million in cash back!

- 5% Cash back: Online shopping and online travel through Upromise.com, and participating Upromise restaurants

- 2% Cash back: Department stores, movie theaters

- 1% Cash back: On all other card purchases

- Earn up to 10% cash back for college: up to 5% when you make eligible purchases through Upromise.com, PLUS 5% when you pay for those purchases with the Upromise MasterCard.

There are other MasterCard Benefits too! Check them out:

- $25 Cash Back Bonus after first eligible use of the card within 90 days

- No limit to the total cash back you can earn on eligible purchases

- $0 fraud liability on unauthorized transactions

- No rotating reward categories

- A chip card makes paying for your purchases more secure at chip card terminals in the U.S. and abroad

- Complimentary FICO® Credit Score

I personally love the Upromise MasterCard! I love how easy it is to link a credit card and start earning cash back from Upromise partners. I also love that there are no hidden fees to sign up and that you can earn gift cards from Upromise partners to go shopping and earn cash back!

Like the sound of $500 million in cash back? Upromise MasterCardcard cardmembers have earned a combined $500 million in cash back for college. Start your college savings journey with the Upromise MasterCard.

How does Upromise help you Ace your savings?

[…] post September is National College Savings Month! appeared first on The […]

I love this! I have three kids, and I shudder to think of what college expenses will be like when they’re old enough. Ugh.

I had no idea September was National College Savings month! My daughter is a high school senior and I have nothing saved. Thankfully, we have a state funded scholarship for their first two years. That will help.

You cannot start early enough! We are on our 3rd child in college and have a high-school senior, it is so expensive!

I didn’t know there was such a thing for the month of September. I think it’s great to save as early as possible. I always give my girls some change to save up for college.

This is something I need to let my daughter know about. She would definitely be able to save some money by doing this.

This is a great post. I have two kids in College right now. I wish I would have started saving a lot earlier then I did. It is so important to start as early as you can.

Good to know about this. We will consider this for the kids.

I had no idea it was national college saving month! I really need to come up with a plan to start saving for both of my boys, it will be here before I know it!

I had no idea about national college saving month. I should pass this onto my daughter she is in college.

My niece and nephew are in high school and are looking into colleges. I’ll have to let my siblings know about the Upromise program so they have another way to save money.

Never too early to get a start on this. The costs are staggering.

This is great. I worry about the cost of college for my 2 kids consistently. It is never to early to start saving!

I have saved quite a bit by using Upromise for my kids. It’s a great way to save for college.

I used to save with UPromise all the time. I’ll have to see if it still works the same these days. Thanks for sharing. – Yolonda