What do you know about the Affordable Care Act?

Do you know much about the Affordable Care Act? I didn’t know that much about it until I participated in a webinar with Anthem Blue Cross and WellPoint spokesperson Ellie Kay and Patrick Blair the other day, thanks to The Motherhood. Did you know that 42% of Americans are unaware that the Affordable Care Act is the law of the land? 45% know nothing at all about the health insurance exchanges and 75% of uninsured adults are unaware that they will have new insurance options.

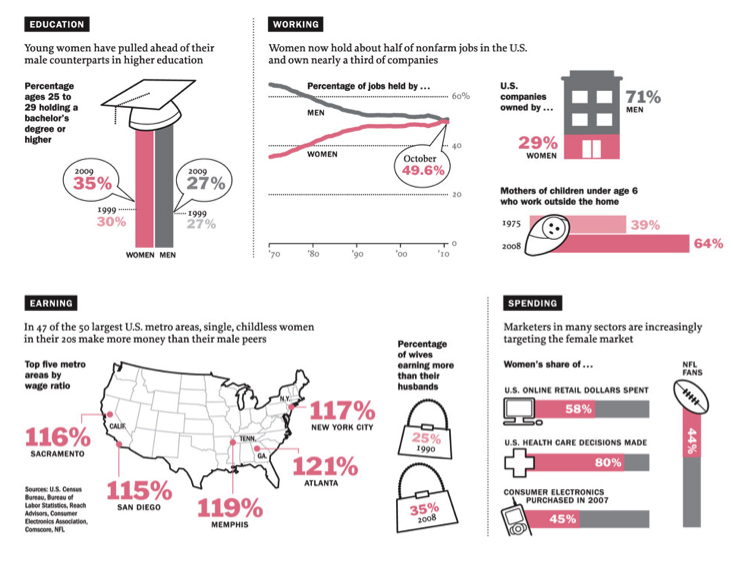

Women and Health Insurance Decision-Making

As women and mothers, it is important for us to know about these upcoming health insurance changes. Why? Women are calling the shots when it comes to health insurance. In fact, 85% of all consumer-purchasing decisions and women make 80% of healthcare decisions. Understanding Medicare Part D plans 2025 is crucial for ensuring we have the best coverage for ourselves and our families.

Why is Health Insurance Important?

So why is health insurance important? Buying health insurance is an important way to protect you and your family in the event of injury or illness. It is also essential to protect your financial future, as injury and illness can be costly without insurance. For instance, the average cost of a 3-day hospital stay is $30,000 or the cost of a broken arm without insurance is $2,500 or more (without surgery). Those are some scary numbers!

How Can I Get Health Insurance?

What are 4 ways we can get health insurance in 2014? (1) Continue purchasing insurance through your or your spouse’s employer. (2) Buy health insurance yourself – either through exchanges, direct for insurance companies or through a traditional ECN broker UK offers locally. (3) Enroll in government programs like Medicare or Medicaid plans – if you are eligible. (4) Go without insurance, but pay a tax penalty.

What is a Health Insurance Exchange and When Can I Use It?

In the next year, you’ll hear the phrase, “Health Insurance Exchange.” What is it? A health insurance “exchange” is just another word for “marketplace.” It works similarly to Amazon, Expedia or Travelocity and lets you compare health insurance options. Public and private health insurance exchanges will operate in a similar way. Plans will be available for sale October 1st, with coverage starting on January 1st of 2014. Each state will have its own exchange, serving people who buy health insurance for just themselves and their families. The vast majority of people who are currently covered by their employers will not see a change or have to use the public exchange.

When can you use the exchanges? Enrollment begins on October 1st, 2013 and ends on March 31st, 2014. Coverage will begin on January 1st, 2014 (for those who sign up before December 15th).

Important Things to Remember

There are a few important things to remember. First, affordable health care will be available and you may qualify for financial help and protect your whole family. Second, you can get preventive health care at no cost and you cannot be denied based on pre-existing conditions. Third, help will be available for those people who make about $45,000 a year and for families of four who make about $92,000 a year. Financial help will be offered on a sliding scale, meaning the more money you make, the less financial help you will get. Knowing this information is an effective way to know if Medigap worth it.

Choosing the Right Health Plan Should Be Simple

Health insurance may not be simple, but choosing the right plan like this Plan G insurance for you and your family should be. Later this Fall, Anthem will have online tools available to help individuals choose the right health plan. First, there will be a Family Checklist, which will provide consumers simple steps to help them select the right health plan. Second, there will be a Subsidy Estimator, which will help members and consumers navigate through their options, including subsidies for qualified individuals and tax credits for small employers.

What Are the Essential Health Benefits That All Plans Offer?

– Emergency Services

– Maternity and newborn care

– Mental health and substance use disorder services

– Preventive and wellness services

– Chronic disease management

– Pediatric services, including oral and vision care

– Women

-

- Won’t be charged more

- Cannot be charged more or denied for a pre-existing condition

- Will get prevent care for mammograms, well woman visits, contraception and much more

- You can choose your own primary care, obgyn atlanta or pediatrician without referrals

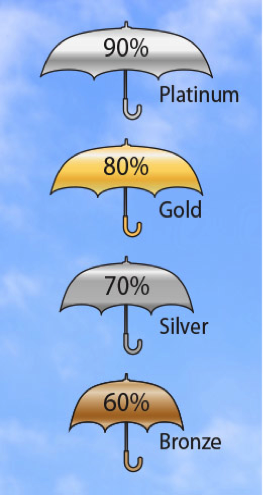

Plans Will Come in Levels or Tiers

Levels are based on the percentage the plan pays of the average overall cost of health benefits. Each level may have a few plans to choose from. Bronze plans have the lowest monthly premium, but will cover 60% of expected costs. Platinum plans have the highest monthly premium, but will cover 90% of expected costs.

Where Can You Go for More Information?

-

-

- There is a website for potential new members to educate on reform laws, what the law means to you, timelines for enrollment and more.

-

Who Can Participate in the Healthcare Exchange?

Practically everyone is eligible for marketplace coverage. Requirements are the individuals live in the U.S., must be a U.S. citizen or national and cannot be currently incarcerated.

What is the Penalty Tax if You Don’t Buy Insurance?

The penalty tax is going to be 1% of your annual income or $95 per individual / $285 per family, depending on which one is greater, and that will go up every year. This will increase over the years with annual adjustments that will continue to 2017. The exception is that if you make $9,500 or less, then you won’t have to pay that penalty tax.

What if I Experience a Job Change that Results in Loss of Insurance? Am I Eligible to Sign Up or Will I Have to Wait?

For benefits starting on or after January 1, 2015, the open enrollment period will run from October 15-December 7, but the law also allows for special enrollment periods, which is a time outside the regular enrollment period. The special enrollments are typically allowed after a significant life event that involves a change in family status like having a baby or getting married or a job change. The ACA gives health insurers operating outside of the exchange the option of limiting open enrollment. So if a plan limits open enrollment, the enrollment must fall into the regular enrollment period.

Does the new healthcare law only apply to those who don’t have other healthcare options through an employer?

Many of the changes in the law are related to the individuals who purchase on their own. There are a variety of changes in the coverage that is offered through employers. In particular, there will be a number of changes for smaller employers. As an example, they will be required to issue coverage to anyone who applies, and they cannot deny coverage to anyone with a pre-existing healthcare condition. It also makes sure that small employers are offering benefit plans that don’t have any lifetime limits on the dollar value of the essential health benefits.

One last element is that the ACA requires that dependent coverage for children until they turn 26 years old. So children are eligible to receive coverage regardless if they are in college, a tax dependent or are married.

Will employers follow the same tier system as the individual tier program?

There is a concept of “grandfathered” health plans. Any health plan that was in force by March 23, 2010, is eligible to be grandfathered forward. These would be plans that meet many requirements of the new healthcare reform. However, if a small employer group – for example – does not have a grandfathered plan, then they would have to offer the metallic tiers within their benefit plan.

What about large employer groups? Businesses that have 50 or more full-time employees are considered a “large business” under the health care law. Beginning in 2015, large employers that do not offer affordable health insurance that provides minimum value to their full-time employees (and dependents) may be required to pay an assessment if at least one of their full-time employees is certified to receive a premium tax credit in the Marketplace. (A full-time employee is one who is employed an average of at least 30 hours per week). This is called The Employer Shared Responsibility Payment.

Are there family plans or only individual plans?

There are both available. As you go to shop, you’ll be asked to enter family information and you will be exposed to those plans that are specifically designed for family coverage.

Does the new law apply only to health care or does it also covers dental and vision? Will this also give people more options for eye, and dental coverage?

As of January 4, the medical plans all have to be compliant with the 10 essential health benefits (listed above). But only pediatric dental and vision benefits are a part of those essential healthcare packages. The law does not expand dental and vision coverage for adults. But they are available for individuals to purchase on a stand-alone basis. So you will have plenty of options for both dental and vision coverage as you shop for your family’s coverage.

How does the new law affect people on Medicaid?

Medicaid is a program for individuals that meet both an income and categorical requirement, for instance a senior with a disability or a child with special needs. The new law was established so that the exchanges can create a new pathway into state Medicaid programs. They want the exchange to be a single integrated application in the process to determine the consumer’s eligibility that will direct individuals to the program that best fits their need.

The ACA actually expanded the eligibility for Medicaid to a larger group of low income Americans. While the Supreme Court has made it optional for states to participate in Medicaid expansion, the threshold for eligibility has changed. If their income is up to 133% of the federal poverty level, they are now eligible for Medicaid. By increasing the federal poverty level, new eligible adults will be covered by Medicaid.

With the increase in population that is now going to be insured do you have a plan to increase staffing to handle the influx?

We have been working very hard to be ready for this! As an organization, we have hired thousands of people to support the surge in enrollment and the care needs that will come with the enrollment. We have individuals who are being trained and are standing by to make sure you have a live representative to speak with on the phone. We are not just focused to make sure we have the right customer service capacity, but we have invested in our information technology and all of our systems that will be used to process claims and premiums, pay physicians and more. We have spent tremendous time and effort identifying the highest quality providers to take on the increase of population. We are also contacting community leaders to make sure that people are aware of our readiness to serve.

Can you dive a little deeper into the cost options and how moms can make it work?

The challenge is that so many things will impact the cost: family, geography, income, and subsidies that you may or may not be eligible for. All of these factors make costs very hard to predict.

What we’ve generally seen is that the changes that are being made will make healthcare more affordable. The more young, healthy individuals we can include in the insurance pools, the more affordable rates are for everyone. The older individuals will likely see their rates go down, while younger healthy individuals might see an increase in their rates. But really, it’s too soon to be able to predict what costs will be like. The design of this system will hopefully have a wonderful uptake, and if that happens, we will see the best possible outcome as it relates to cost.

For many, health care reform will mean access to care for the first time in their lives and for others it means access to expanded care. Expanded benefits will include doctors’ visits and outpatient services, emergency care, maternity and newborn care, and prescription drugs. Screenings, shots and exams will be included for free, and plans with lower deductibles will be offered as well as subsidies for people who need them. Not only will benefits be more expansive, but under the new law more people will be covered and that is a good thing.

But along with expanded benefits come higher costs – and health insurers are faced with a choice; either pass those costs on to their members – or figure out ways to manage those costs so that health insurance remains affordable. For those who have trouble paying for their coverage, government subsidies will be available to them making the products affordable.

What are your thoughts about the new Affordable Health Care Act?

[wl_faceted_search]

I need to start reading about this and they have been talking about The Affordable Health Care Act on the news for some time. I have a link to a site and I need to look up what it is all about. I think that it is a very good thing because there are so many people that can not afford Health care like myself and my son. My son will be able to afford Health Care now!! I am so excited about this!!

Frankly some of this scares me. I know people who are uninsured and small business owners – I think there is going to be a huge problem with this whole thing. I also am not fond of the ‘tier’ system I tink it promotes ‘classism’ and I am not totally convinced the government can ;force’ anyone to buy anything.

Thankfully we have insurance through my husband job so this won’t affect us. My biggest problem is the penalty people who don’t have insurance will have to pay. Odd are they don’t have insurance because they can’t afford it so how are they going to be able to pay the penalty? If feels like more government intrusion to me.

I am thankful to have great coverage at work, but I know many people don’t have this option so it is nice that with the law of the land everyone can get insurance.